The 8-Minute Rule for Mortgage Broker

Wiki Article

Some Known Incorrect Statements About Mortgage Broker

Table of ContentsMortgage Broker - The FactsNot known Incorrect Statements About Mortgage Broker The Ultimate Guide To Mortgage BrokerThe 20-Second Trick For Mortgage BrokerUnknown Facts About Mortgage BrokerFascination About Mortgage BrokerThe 5-Second Trick For Mortgage Broker

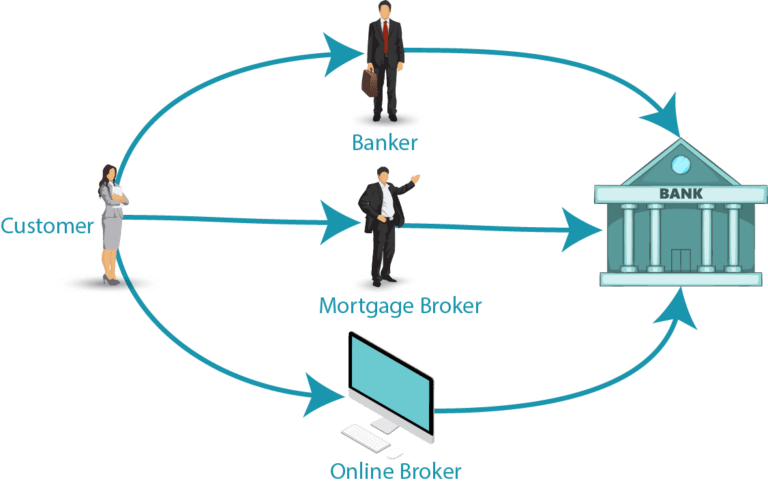

What Is a Home mortgage Broker? The mortgage broker will work with both parties to obtain the individual approved for the car loan.A home mortgage broker commonly works with lots of various loan providers and can offer a range of lending alternatives to the borrower they function with. What Does a Home mortgage Broker Do?

The Base Line: Do I Need A Home Loan Broker? Collaborating with a home mortgage broker can save the customer time and also effort during the application procedure, and possibly a whole lot of money over the life of the financing. On top of that, some loan providers function solely with mortgage brokers, meaning that consumers would have accessibility to car loans that would or else not be offered to them.

The Ultimate Guide To Mortgage Broker

It's essential to analyze all the costs, both those you might have to pay the broker, in addition to any costs the broker can aid you prevent, when weighing the choice to deal with a mortgage broker.Having a professional that can describe things plainly and also comprehends best method can be invaluable. Disadvantages home loan brokers aren't constantly free and can include to your expenses at a time when you're trying to conserve as much cash as feasible.

not all brokers will certainly have accessibility to the entire home loan market, meaning depending solely on a broker can limit your choices. Some brokers might prefer specific lenders if they have excellent relationship with them. You can and also must constantly ask a broker the amount of loan providers they collaborate with and if they prefer any kind of particular loan providers.

All about Mortgage Broker

See to it to vet them meticulously and get recommendations where possible. How a lot does a mortgage broker cost? As you may anticipate, home loan broker costs will vary from broker to broker and also are influenced by a selection of elements, such as just how much you intend to obtain. The average cost for a home mortgage broker is around 500 *, but different brokers can charge in different methods: the broker will set a fixed charge to find and set up a home loan for you (which you should constantly concur in composing before engaging them).

I thought the very same point when I acquired a home in 2016. It had not been my very first time purchasing-- I 'd possessed a home before with my ex-husband.

Some Ideas on Mortgage Broker You Should Know

What Mortgage Brokers Do If you have actually never ever acquired a residence in the past, you could not recognize what mortgage brokers are all about. And also in exchange for offering the broker those details, they take care of all the training of mortgage lending buying.You do not have to invest hrs seeking a car loan since the broker is taking care of that. Home mortgage brokers' duties Home mortgage brokers have specialist expertise and also resources the average house purchaser doesn't. They typically have a larger network of lenders they collaborate with so they can truly drill to what sorts of car loans you're most likely to get approved for as well as what interest price you're most likely to obtain.

That's all to the good due to the fact that the reduced your rate, the lower the overall cost of borrowing winds up being. And besides all that, the home mortgage broker see this website takes treatment of connecting with the home loan lender when you pick a car loan. You give the broker all the documents and also details the lender requires for underwriting.

Some Ideas on Mortgage Broker You Need To Know

Preferably, all you have to do is address any type More about the author of follow-up inquiries the lending institution routes to the broker. The price of using a mortgage broker In return for doing all that,.In this way, you pay nothing out of pocket. All of that sounded fantastic to me when I prepared to buy again. I was dealing with growing my freelancing business and also increasing 2 children as well as I just didn't have time to obtain stalled in the information of locating a home loan.

He asked me to validate an electronic kind offering him approval to check my credit rating - mortgage broker. I agreed and a number of hrs later, he returned with some first rate quotes for a couple of various kinds of loans (FHA, traditional and USDA). From there, I proceeded to the next action: getting pre-approved.

The Ultimate Guide To Mortgage Broker

Which I did. By the time the broker got clued in and also allow me recognize, I 'd already filled up out the full mortgage application for the car loan, with the difficult questions on my credit scores report to prove it. This is regarding a month into collaborating with the broker. So while I was a little frustrated, I requested for the following choice, which was an FHA finance.

(And I'm not doing this online either-- I needed to submit paper applications as well as pay to have them Fed, Exed to the broker overnight.) Given that a month had actually gone by from my last time using, I also needed to go back as well as get brand-new copies of all my bank and also monetary declarations.

The Mortgage Broker Diaries

The excellent news was: I was accepted for the financing click site rather quickly afterwards. There were still much more bumps in the road to come. I repeatedly had to email copies of my parasite, septic and also house evaluation records because the broker kept misplacing them. I needed to pay to submit a copy of my separation contract with my local registrar's workplace since the broker informed me I needed to-- only to locate out later the loan provider really did not care anything concerning it.Report this wiki page